Accounting for GASB 87 and GASB 96

GASB 87 and GASB 96 are similar, yet different. Both share the characteristic of further complicating accounting in the name of financial clarity....

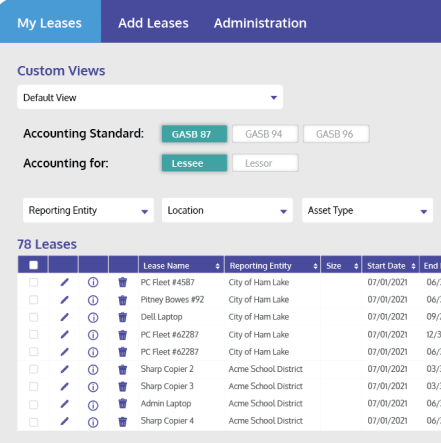

Simplify implementation and ensure compliance with GASB 87, 94, and 96 using our streamlined lease accounting software.

At LeaseCrunch, you’ll never need to worry about knowing the ins and outs of GASB lease accounting standards. Start implementing and keeping track of your government leases, PPPs, or SBITAs in minutes with our streamlined lease accounting software.

Get set up quickly. No matter if you’re the lessee or lessor, how many leases, PPPs, or SBITAs you need to enter, or what tool you previously utilized, our streamlined interface and in-app tools make implementation a breeze.

Generate journal entries, quantitative footnote disclosures, and amortization schedules with the push of a button.

Eliminate the risk of overlooking critical lease events. Set consistent email alert rules across all affected leases, PPPs, and SBITAs immediately upon implementation.

Integrated validation checks improve data input accuracy and ensure compliance with all GASB lease accounting standards and requirements.

While maintaining compliance with GASB lease accounting standards is difficult in Excel, our Reports Center provides pre-populated spreadsheets and audit trails so you can easily update ERP systems.

Having trouble with GASB 87, 94, or 96? LeaseCrunch’s live or on-demand training and team of lease accounting experts are always available to help.

Avoid GASB 96 and GASB 87 spreadsheet errors and improve your overall lease accounting processes in a few simple steps.

LeaseCrunch was instrumental in helping us win the Government Finance Officers Association Certificate of Excellence Award in Financial Reporting

When the City of Twinsburg applied for the GFOA Certificate of Excellence Award in Financial Reporting, LeaseCrunch helped make sure full compliance with GASB standards was achieved and provided detailed, accurate reporting.

GASB 87 and GASB 96 are similar, yet different. Both share the characteristic of further complicating accounting in the name of financial clarity....

Navigating leases can be a challenge, especially when it comes to distinguishing between a lessee and a lessor. At their very heart, leases require...

Lease accounting gets increasingly complicated with each new accounting standard introduced by the Governmental Accounting Standards Board, also...

On March 29th, LeaseCrunch held a live webinar discussing the definition, exclusions, and implementation of GASB 96, along with SBITA examples,...

In May 2020, the Governmental Accounting Standards Board postponed the implementation date for the new lease standard, GASB 87 to June 15, 2021. At...

GASB 87 is effective for fiscal years beginning after June 15, 2021, and all reporting periods thereafter—believe it or not, that’s right around the...

Schedule a demo today to try our best-in-class lease accounting software for free!