Lease Accounting Software Built for CPA Firms

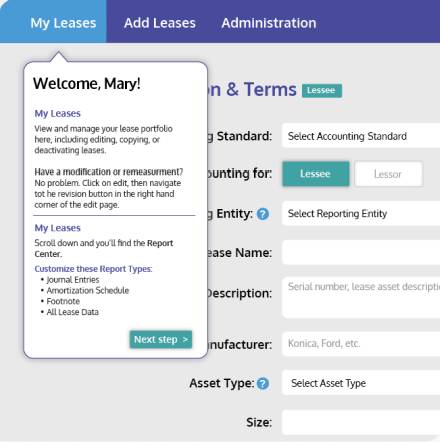

Automate your clients' lessee and lessor lease accounting reporting requirements in minutes with our easy-to-use, cloud-based lease accounting solution for CPA firms.

Accounting Standards We Help Your Clients Comply With

Why CPA Firms Choose LeaseCrunch

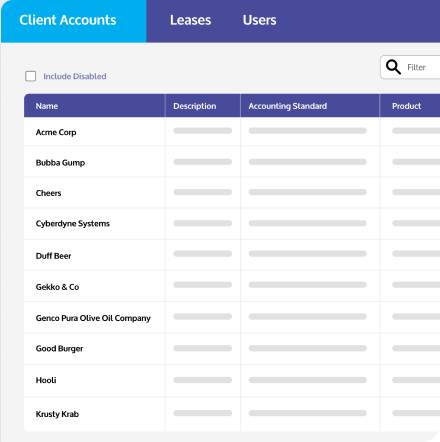

Easily Collaborate With Your Clients

Effortlessly collaborate with your clients through LeaseCrunch's Dual Access functionality, offering role-based permissions and access. This allows you to eliminate version control issues and maintain a transparent audit trail.

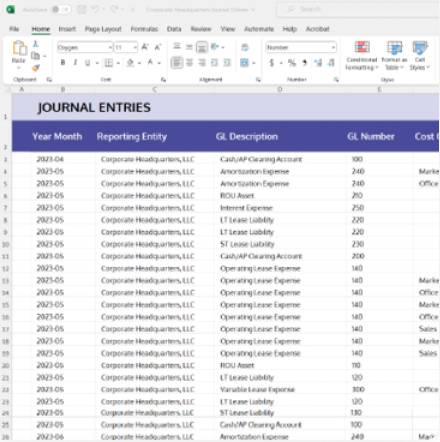

Generate Accurate Reports With the Push of a Button

Firm staff can download audit-ready and error-free journal entries, amortization schedules and footnote disclosures with the push of a button.

Live and On-Demand Training

Experience top-tier support tailored to your needs with LeaseCrunch. Whether you're navigating the lease accounting standards or the software or both, our elite team made up of CPAs, former Big Four public accounting auditors, and former FASB staff is at your service.

SOC 1 Type II and SOC 2 Type II Reports

Each year we complete SOC 1 and SOC 2 reports which shows our commitment to providing LeaseCrunch users with the confidence they need for financial reporting accuracy and that we have industry standard and best-practice internal controls and safeguards to protect their data.

LeaseCrunch played a crucial role in making it a smooth experience

Successfully navigating the ASC 842 transition was a top priority for us. LeaseCrunch played a crucial role in making it a smooth experience. Our team found that its user-friendly interface and powerful features truly made a difference.

Easily Collaborate With Your Clients Without Jeopardizing Independence

Not only is LeaseCrunch affordable and scalable, but with best-in-class Dual Access functionality, fully supporting your clients has never been easier. From role-based invitations and permissions to optional review and approval features, you can work hand in hand with your clients from a single dashboard.

LeaseCrunch’s dual-access:

Eliminate Lease Accounting Errors

Download error-free, audit-ready reports efficiently. We ensure seamless reporting of journal entries, amortization schedules, footnote disclosures, and more for CPA firms and their clients across all lease accounting standards.

With the Reports Center, CPA firms can store key report insights and exported reports for 45 days. You can also download multiple reports at once so users can work while reports are being generated ensuring uninterrupted workflows. This allows you to be as productive and efficient as possible.

Get Personalized, White-Glove Support

No matter the standard you’re working with, LeaseCrunch’s guidance and support is elite. From in-app wizards to our personalized customer support, our team of CPAs, Big Four public accounting auditors, software development veterans, and former FASB staff understand the ins and outs of the lease accounting industry.

Also, with access to guides, our rich knowledge base, our easy-to-use interface, and on-demand training, we’ll answer any questions your firm or your clients have about using our software or solving lease accounting’s toughest questions.

SOC 1 Type II and SOC 2 Type II Reports

LeaseCrunch users can trust our unwavering commitment to upholding industry standards and best practices in internal controls and safeguarding data. With the annual completion of SOC 1 Type II and SOC 2 Type II reports, we are dedicated to the accurate financial reporting of both our clients and their clients and the implementation of rigorous internal processes.

Scalable, cloud-based lease accounting software built for CPA firms, companies, and government entities.

An easy tool for CPA firms to audit their client’s lease accounting, checking for errors and ensuring accuracy.

Automated, cloud-based pathway from accounting systems to standard, comprehensive Excel workbooks.

Start Automating All of Your Client’s Lease Accounting With LeaseCrunch

Schedule a demo today to try our best-in-class lease accounting software for free!