If you have entered an incorrect Initial Application Date for a Reporting Entity, a new Reporting Entity can be created and the leases can be transferred to that entity.

- If no leases have been added to the Reporting Entity, navigate to Administration - Reporting Entity to adjust the date.

- If a lease has been added to the Reporting Entity, follow the process below to adjust.

To Determine the initial application date under FASB ASC 842, click here for our FASB Initial Application Date calculator.

To determine the Initial Application Date under GASB 87, click here for our GASB Initial Application Date calculator.

To correct the Initial Application Date on a Reporting Entity where the current Initial Application Date is earlier than it should be, follow the steps below:

- In Administration-Reporting Entity, edit the incorrect Reporting Entity and deselect the Enabled checkbox. This must be done by a user with the Administrator role.

- Add a new Reporting Entity with the correct Initial Application Date. This must be done by a user with the Administrator role.

- Update Locations, if applicable. Locations are Reporting Entity Specific

- Update GL Accounts for the new Reporting Entity. GL Accounts are Reporting Entity Specific

- Edit each lease associated with the incorrect Reporting Entity to be associated with the correct Reporting Entity following this order of operations:

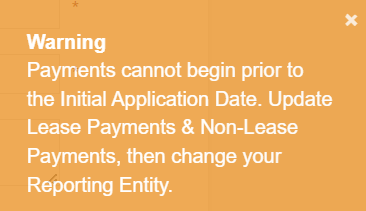

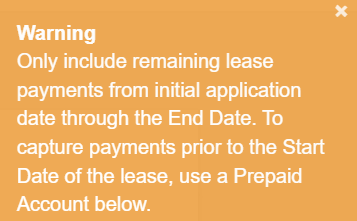

- Lease Payments: Make sure the start of lease payments is on or after the Initial Application Date of the correct Reporting Entity. This applies to Variable & Non-lease Payments as well.

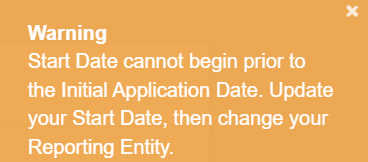

- Lease Start Date: Make sure the lease start date is on or after the Initial Application Date of the correct Reporting Entity.

- Reporting Entity: Now change the Reporting Entity on each lease.

- Please note that if this order of operations is not followed, you may get one of the error messages below:

To correct the Initial Application Date on a Reporting Entity where the Initial Application Date is later than it should be, follow the steps below:

- In Administration-Reporting Entity, edit the incorrect Reporting Entity and deselect the Enabled checkbox.

- This must be done by a user with the Administrator role.

- Add a new Reporting Entity with the correct Initial Application Date. This must be done by a user with the Administrator role.

- Update Locations, if applicable. Locations are Reporting Entity Specific

- Update GL Accounts for the new Reporting Entity. GL Accounts are Reporting Entity Specific

- Edit each lease associated with the incorrect Reporting Entity to be associated with the correct Reporting Entity following this order of operations:

- Reporting Entity: Change the Reporting Entity on each lease.

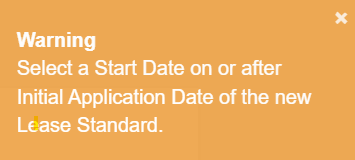

- Lease Start Date: Make sure the lease start date is on or after the Initial Application Date of the correct Reporting Entity.

- Lease Payments: Make sure the start of lease payments is on or after the Initial Application Date of the correct Reporting Entity. This applies to Variable & Non-lease Payments as well.

- Please note that if this order of operations is not followed, you may get one of the error messages below:

Note: In order to adjust the dates and Reporting Entity, some lease payments may need to be deleted and re-added.

-

- Description & Term Tab: Update the Location, if applicable.

- Lease Payments & Classification Tab: Re-enter any deleted lease payments.

- Update GL Accounts if there are Existing Balances under Previous Lease Guidance for transition leases. (Lease Payments tab or Lease Receipts tab for GASB)

- GL Accounts: Review and Save to update the accounts to relate to the new Reporting Entity.

- Variable Expense & Non-Lease Payments: Update GL Accounts, if applicable.

.png?height=120&name=LC-Logo-HiRes-Purple%20(1).png)